Picture this: It’s the end of the month, and you’re staring at your bank account wondering where all your money went. I’ve been there, and trust me, it’s not a great feeling. Managing personal finances can feel like trying to tame a wild beast, especially when unexpected expenses pop up out of nowhere. But here’s the good news: With the right strategies and tools, you can master your money and take control of your financial future.

Importance of Personal Finance Management for Men

Why is managing personal finances so crucial for men? For starters, having control over your finances provides a sense of security and peace of mind. It allows you to plan for the future, whether that’s buying a home, starting a family, or simply enjoying a comfortable retirement. Plus, let’s be honest, it’s pretty empowering to know exactly where your money is going and how to make it work for you. So, let’s dive into the nuts and bolts of effective money management, starting with the basics.

Why is Managing Personal Finances Important for Men?

Managing personal finances is vital for every man. It’s not just about keeping track of where your money is going, but also about ensuring your financial future is secure. Let’s face it, life throws curveballs—unexpected expenses, job changes, and even economic downturns. By mastering personal finance, you can navigate these challenges with confidence.

One major hurdle many men face is the accumulation of bad financial habits. According to an article on 8 Wealth-Destroying Habits to Ditch for Financial Freedom, avoiding these habits can pave the way to a more stable financial future. It’s about making informed decisions and setting yourself up for success, both now and in the long run.

Having a solid grasp of your finances also opens up opportunities. Whether it’s investing in the stock market, starting your own business, or simply taking a well-deserved vacation, good financial management gives you the freedom to make those choices without stress. Plus, knowing you have a financial cushion can provide peace of mind, allowing you to focus on other aspects of life.

How Do I Start Creating a Budget Plan?

Creating a budget plan is the foundation of good financial management. Here’s how to get started:

- List Your Income: Document all sources of income, including your salary, side gigs, and any other earnings. Knowing your total income is the first step to understanding how much you have to work with each month.

- Track Your Expenses: Write down all your monthly expenses. This includes rent or mortgage, utilities, groceries, transportation, entertainment, and any other regular outgoings. Don’t forget to include occasional expenses like car maintenance or gifts.

- Categorize Expenses: Break down your expenses into fixed (rent, utilities) and variable (entertainment, dining out). This helps you see where you can potentially cut back.

- Set Financial Goals: Determine what you want to achieve with your money. This could be paying off debt, saving for a vacation, or building an emergency fund. Having clear goals will keep you motivated and focused.

- Create the Budget: Allocate your income to each expense category based on your tracking. Make sure your total expenses don’t exceed your income. If they do, it’s time to make some adjustments.

- Monitor and Adjust: A budget isn’t a one-and-done deal. Review your budget regularly and make adjustments as needed. Life changes, and so should your budget.

If you’re looking to enhance your skills, check out these 5 Essential Skills Every Man Should Master, which include tips on managing finances effectively.

Budgeting might seem tedious at first, but once you get into the habit, it becomes second nature. Plus, the benefits of having financial control far outweigh the initial effort.

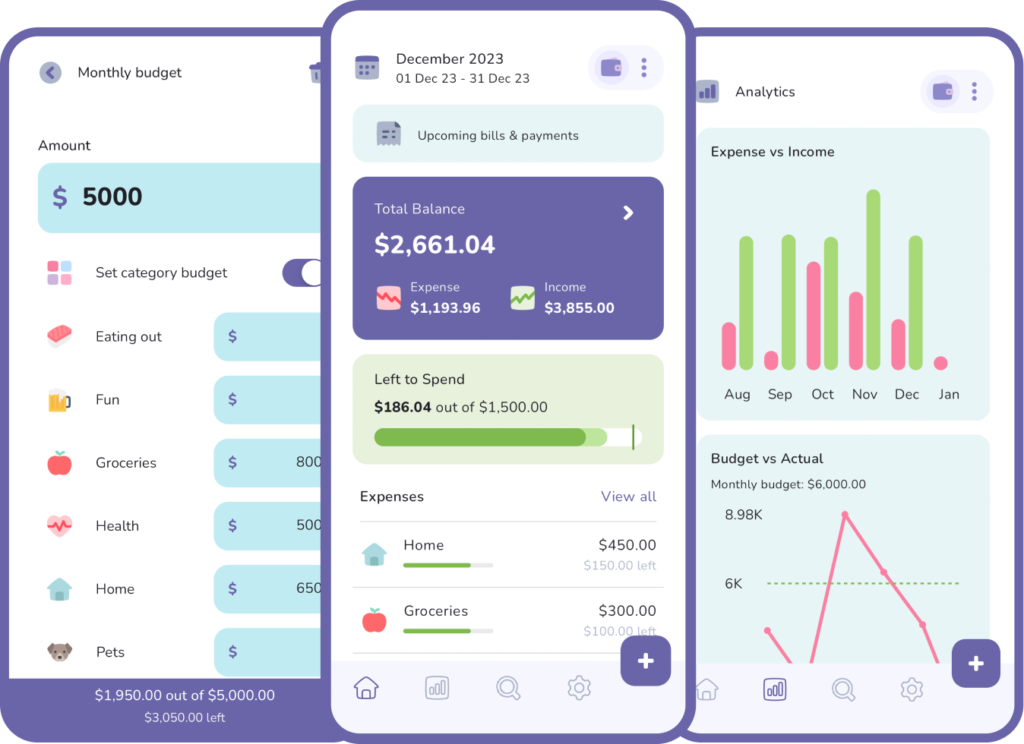

What Are the Best Budgeting Apps for Men?

In today’s digital age, there are numerous tools available to help you manage your money more effectively. Budgeting apps are particularly useful, as they can simplify the process and help you stay on track. Here are some of the best budgeting apps for men:

- Mint: Mint is one of the most popular budgeting apps out there. It allows you to connect all your bank accounts, credit cards, and bills in one place. The app automatically categorizes your transactions and provides insights into your spending habits. Plus, it offers alerts for due dates and low balances.

- YNAB (You Need A Budget): YNAB is great for those who want a more hands-on approach to budgeting. It encourages you to give every dollar a job and helps you plan for future expenses. The app also offers educational resources to help you improve your financial literacy.

- PocketGuard: If simplicity is what you’re after, PocketGuard is a solid choice. It shows you how much you have left to spend after accounting for bills, goals, and necessities. This app helps you avoid overspending and stick to your budget.

- Personal Capital: Personal Capital is more than just a budgeting app; it’s a comprehensive financial management tool. In addition to budgeting features, it offers investment tracking and retirement planning tools. This makes it a great choice for those looking to manage their finances holistically.

- Goodbudget: Goodbudget is based on the envelope budgeting method, where you allocate money for different categories into virtual envelopes. It’s a great tool for couples or families, as it allows you to share and sync budgets across multiple devices.

Using a budgeting app can significantly simplify the process of managing your finances. These tools provide insights and automation that make it easier to stick to your budget and reach your financial goals. Plus, they can help you identify areas where you can cut back and save more money.

What Are Some Practical Saving Strategies for Men?

Saving money doesn’t have to mean living a life of deprivation. With the right strategies, you can build your savings while still enjoying life. Here are some practical tips to help you save more effectively:

- Automate Your Savings: One of the easiest ways to save is to automate it. Set up automatic transfers from your checking account to your savings account each month. This way, saving becomes a regular part of your financial routine, and you’re less likely to spend that money.

- Cut Unnecessary Expenses: Take a hard look at your spending and identify areas where you can cut back. Do you really need that premium cable package or daily latte? Trimming these expenses can add up over time. For example, opting for home-cooked meals over dining out can save you a significant amount.

- Use Cash-Back and Rewards Programs: Take advantage of cash-back and rewards programs offered by your credit cards. Just be sure to pay off your balance each month to avoid interest charges. Additionally, apps like Rakuten and Honey can help you earn cash back on online purchases.

- Find Affordable Alternatives: Look for budget-friendly alternatives to your regular expenses. For instance, instead of an expensive gym membership, consider working out at home or using free outdoor spaces. And if you’re into grilling, you might want to check out the Grill Anywhere: The Foreman Electric Grill Experience for an affordable and convenient option.

- Increase Your Income: Sometimes, saving more means earning more. Look for opportunities to increase your income through side gigs, freelance work, or asking for a raise at your current job. Every extra dollar can help boost your savings.

- Set Specific Savings Goals: Having a clear goal can make saving more motivating. Whether it’s a vacation, a new gadget, or an emergency fund, knowing what you’re saving for can help you stay focused. Break your goal into smaller, manageable milestones to track your progress.

- Review Subscriptions and Memberships: Regularly review your subscriptions and memberships. Cancel any that you’re not using or that don’t provide enough value. This can include streaming services, magazines, and memberships to clubs or organizations.

- Take Advantage of Sales and Discounts: Be smart about shopping. Use coupons, wait for sales, and buy in bulk when it makes sense. Just make sure you’re buying items you actually need and will use.

Implementing these strategies can help you build your savings without feeling like you’re constantly sacrificing. The key is to make saving a habit and to look for small changes that can have a big impact over time.

How Do I Build an Emergency Fund?

Building an emergency fund is one of the most crucial steps in managing your personal finances. An emergency fund acts as a financial safety net, providing you with the cushion you need to handle unexpected expenses without falling into debt. Here’s how to get started:

- Set a Realistic Goal: Aim to save at least three to six months’ worth of living expenses. This amount will vary based on your lifestyle, job stability, and personal circumstances. For instance, if your monthly expenses total $3,000, you should aim to save between $9,000 and $18,000.

- Start Small: If saving a large sum feels overwhelming, start with a smaller goal, like $1,000. Once you reach this milestone, you can gradually increase your savings target. The key is to start saving regularly, even if it’s just a small amount.

- Open a Separate Savings Account: Keep your emergency fund in a separate savings account that’s not easily accessible for everyday spending. An online savings account can be a good option as it typically offers higher interest rates and limited access.

- Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund. Automating your savings ensures you consistently put money aside without having to think about it. Treat it like any other bill you pay each month.

- Cut Back on Non-Essentials: To boost your emergency fund faster, look for areas where you can cut back on spending. This might mean dining out less, cancelling unused subscriptions, or finding cheaper alternatives for some of your regular expenses.

- Use Windfalls Wisely: If you receive unexpected money, such as a tax refund, bonus, or inheritance, consider putting a significant portion of it into your emergency fund. This can give your savings a substantial boost without affecting your regular budget.

- Track Your Progress: Regularly review your savings to stay motivated. Seeing your emergency fund grow can provide a sense of accomplishment and encourage you to keep saving.

Building an emergency fund takes time and discipline, but the peace of mind it offers is well worth the effort. Once you have your fund in place, you’ll be better prepared to handle life’s financial surprises.

For those considering early retirement strategies, exploring options like Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return can be beneficial for long-term planning.

What Are the Best Ways to Manage Debt?

Managing debt effectively is crucial to maintaining financial health. Whether it’s student loans, credit card debt, or a mortgage, having a plan to tackle your debt can make a significant difference. Here are some strategies to help you manage and reduce your debt:

- Create a Debt Inventory: Start by listing all your debts, including the amounts owed, interest rates, and minimum monthly payments. This will give you a clear picture of your overall debt situation and help you prioritize which debts to tackle first.

- Focus on High-Interest Debt: Prioritize paying off high-interest debts, such as credit card balances, as quickly as possible. The higher the interest rate, the more you end up paying over time. Use the avalanche method to pay off high-interest debt first while making minimum payments on other debts.

- Consider Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can simplify payments and save money on interest. Look into options like personal loans or balance transfer credit cards.

- Negotiate with Creditors: Don’t hesitate to reach out to your creditors to negotiate better terms. They may be willing to lower your interest rate, waive fees, or set up a more manageable payment plan. It never hurts to ask.

- Create a Debt Repayment Plan: Outline a plan to pay off your debts systematically. The snowball method, which involves paying off the smallest debts first, can provide quick wins and build momentum. Alternatively, the avalanche method focuses on paying off debts with the highest interest rates first.

- Cut Unnecessary Expenses: Free up extra money to put toward your debt by cutting back on non-essential spending. This might involve dining out less, canceling subscriptions, or finding cheaper alternatives for certain expenses.

- Increase Your Income: Look for ways to boost your income, whether it’s through a side gig, freelance work, or even asking for a raise at your current job. Additional income can be directed toward paying off your debt faster.

- Stay Motivated and Track Your Progress: Paying off debt can be a long journey, so it’s important to stay motivated. Celebrate small victories along the way and regularly review your progress to stay on track.

Remember, managing debt is not just about paying it off but also about avoiding new debt. Educate yourself on common pitfalls, such as 5 Sneaky Car Dealership Tactics Every Man Should Watch Out For, to prevent future financial setbacks.

How Can I Set and Achieve Long-Term Financial Goals?

Setting and achieving long-term financial goals is a key component of financial success. Whether you’re saving for retirement, buying a home, or planning for your children’s education, having a clear plan can make these goals attainable. Here’s how to do it:

- Define Your Goals: Start by clearly defining your long-term financial goals. Be specific about what you want to achieve, whether it’s retiring at 60, buying a house in five years, or saving for your kids’ college education. Specific goals are easier to plan for and measure.

- Break Down Your Goals: Large goals can be overwhelming, so break them down into smaller, manageable milestones. For example, if you want to save $100,000 for a house down payment in five years, aim to save $20,000 each year or about $1,667 each month.

- Create a Plan: Develop a detailed plan for how you’ll achieve each goal. This might include creating a budget, setting up automatic savings, or investing a portion of your income. Use tools like spreadsheets or financial planning apps to keep track of your progress.

- Invest Wisely: Investing can significantly boost your ability to achieve long-term goals. Consider investing in stocks, bonds, or mutual funds that align with your risk tolerance and time horizon. For inspiration, read about the power of S&P 500 returns and how they can grow your wealth over time.

- Stay Disciplined: Achieving long-term goals requires discipline and consistency. Stick to your plan, make regular contributions to your savings and investments, and avoid unnecessary expenses that can derail your progress.

- Review and Adjust: Life changes, and so might your goals. Regularly review your financial plan and adjust it as needed. This could involve increasing your savings rate, reallocating investments, or setting new goals as old ones are achieved.

- Seek Professional Advice: Consider consulting with a financial advisor to help you develop and implement a comprehensive financial plan. They can provide personalized advice and strategies to help you reach your long-term goals.

- Stay Informed and Educated: Keep learning about personal finance and investment strategies. This knowledge will empower you to make informed decisions and adapt to changes in your financial situation.

By setting clear goals and following a structured plan, you can turn your financial dreams into reality. And remember, it’s a marathon, not a sprint. Stay patient and persistent.

If you’re looking for additional ways to earn extra income, consider reading about My Journey to $10k a Year Selling Photos Online.

How Can I Maximize My Retirement Savings?

Maximizing your retirement savings is essential to ensure a comfortable and financially secure future. Here are some effective strategies to help you boost your retirement funds:

- Start Early: The sooner you start saving for retirement, the better. Thanks to compound interest, even small contributions can grow significantly over time. If you haven’t started yet, don’t worry—it’s never too late to begin.

- Contribute to Employer-Sponsored Plans: Take full advantage of employer-sponsored retirement plans like a 401(k). Contribute at least enough to get the full company match if one is offered. This is essentially free money that can accelerate your savings.

- Max Out IRA Contributions: Individual Retirement Accounts (IRAs) offer tax advantages that can help grow your savings. Max out your contributions each year to take full advantage of these benefits. For 2024, the contribution limit for IRAs is $6,500, or $7,500 if you’re 50 or older.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify your retirement portfolio across various asset classes, including stocks, bonds, and real estate. This reduces risk and can lead to more stable returns over time.

- Increase Contributions Over Time: As your income grows, increase the amount you’re saving. Consider setting up automatic increases to your retirement contributions each year. Even a small annual increase can make a big difference in the long run.

- Take Advantage of Catch-Up Contributions: If you’re 50 or older, you can make catch-up contributions to your retirement accounts. This allows you to contribute more each year, which can help you boost your savings as you approach retirement.

- Avoid Early Withdrawals: Withdrawing from your retirement accounts before retirement age can result in significant penalties and tax liabilities. Try to avoid dipping into these funds unless it’s an absolute emergency.

- Consider Delaying Social Security: Delaying Social Security benefits can significantly increase your monthly payments. For example, if you delay from age 62 to 70, your benefits can increase by up to 76%. For a detailed strategy, check out Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return.

By following these strategies, you can maximize your retirement savings and build a nest egg that will provide you with financial security in your golden years. Remember, consistency and smart planning are key to successful retirement savings.

What Are Some Smart Investment Options for Men?

Investing wisely is a cornerstone of building wealth and securing your financial future. Here are some smart investment options that can help you grow your money effectively:

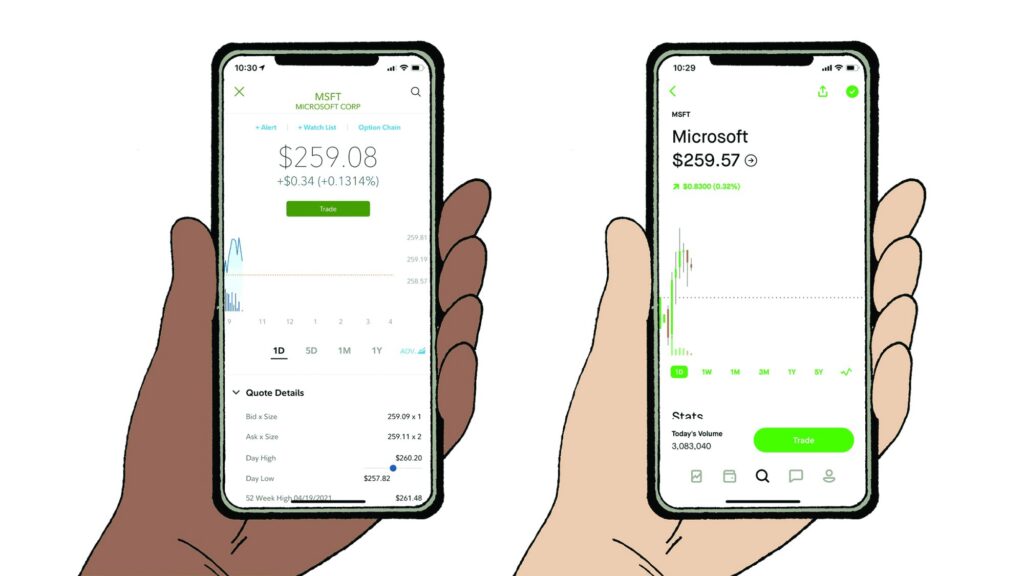

- Stocks: Investing in individual stocks can offer high returns, but it comes with higher risk. Diversifying your stock portfolio across different sectors and industries can help mitigate this risk. For beginners, platforms like Robinhood make it easy to start trading. Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App can help you get started.

- Mutual Funds and ETFs: These investment vehicles pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, making them a good option for those who prefer a hands-off approach.

- Bonds: Bonds are generally less volatile than stocks and can provide steady income through interest payments. Government and corporate bonds are popular choices. Including bonds in your portfolio can balance the higher risk of stocks.

- Real Estate: Investing in property can be a lucrative way to build wealth. Rental properties can generate passive income, and real estate values tend to appreciate over time. Real estate investment trusts (REITs) are a way to invest in real estate without owning physical property.

- Index Funds: These funds track a specific index, like the S&P 500, and offer broad market exposure with low fees. They are a great option for long-term investors looking to capitalize on overall market growth.

- Retirement Accounts: Maximize contributions to retirement accounts like 401(k)s and IRAs. These accounts offer tax advantages that can significantly enhance your savings over time. If you’re new to investing, consider starting with these tax-advantaged accounts.

- Peer-to-Peer Lending: This involves lending money directly to individuals or small businesses through online platforms. While it can offer higher returns than traditional savings accounts, it also carries higher risk.

- Cryptocurrency: Investing in digital currencies like Bitcoin and Ethereum can offer high returns, but they are highly volatile. If you’re considering this option, start small and be prepared for significant price fluctuations.

To make the most of these investment options, educate yourself and stay informed about market trends. Tools like the Robinhood app can be especially useful for new investors looking to Unlock Your Investment Potential. With the right knowledge and strategy, you can build a robust investment portfolio that aligns with your financial goals.

How Can I Avoid Common Financial Pitfalls?

Avoiding common financial pitfalls is crucial for maintaining and growing your wealth. Here are some strategies to help you steer clear of mistakes that can derail your financial plans:

- Avoid Lifestyle Inflation: As your income increases, it’s tempting to upgrade your lifestyle. However, this can lead to spending all of your extra income instead of saving it. Try to maintain your current lifestyle and save or invest the additional income.

- Stay Out of High-Interest Debt: Credit card debt and payday loans can quickly spiral out of control due to high interest rates. Pay off your balances in full each month to avoid interest charges, and consider using cash or debit for purchases to stay within your budget.

- Have an Emergency Fund: Without an emergency fund, unexpected expenses can force you into debt. Aim to save three to six months’ worth of living expenses in a separate savings account. This cushion can help you handle financial surprises without resorting to credit.

- Invest Wisely: Avoid putting all your money into high-risk investments. Diversify your portfolio to balance risk and potential return. For new investors, learning the basics through resources like Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App can provide a solid foundation.

- Don’t Neglect Retirement Savings: It can be tempting to put off saving for retirement, but the earlier you start, the more time your money has to grow. Take advantage of employer-sponsored plans and IRAs, and aim to increase your contributions over time.

- Avoid Impulse Purchases: Impulse buying can wreak havoc on your budget. Give yourself a cooling-off period before making large purchases. This will help you determine if you really need the item or if it’s just a passing desire.

- Educate Yourself: Financial literacy is key to making informed decisions. Continuously educate yourself about personal finance, investment strategies, and money management. Reading articles and guides, such as those on financial websites, can provide valuable insights.

- Beware of Wealth-Destroying Habits: Certain habits can undermine your financial health. Identify and eliminate behaviors that drain your resources. Check out 8 Wealth-Destroying Habits to Ditch for Financial Freedom to learn more about avoiding these common pitfalls.

By being mindful of these pitfalls and taking proactive steps to avoid them, you can maintain better control over your finances and work towards achieving your long-term goals. Remember, financial success is often about making smart, consistent choices over time.

As an Amazon Associate we earn from qualifying purchases through some links in our articles.