Navigating the world of personal finance and budgeting can be a daunting task, but it’s crucial for achieving financial stability and success. Here are some fundamental aspects of personal finance and budgeting that every man should know:

Understanding Your Income and Expenses

The first step in personal finance is understanding your income and expenses. Know how much money you’re bringing in each month and where it’s going. This includes your salary, any side income, and regular expenses like rent, utilities, groceries, and entertainment. Tracking your expenses helps in identifying areas where you can cut back and save money.

Creating a Budget

A budget is a financial plan that helps you manage your money effectively. It involves allocating specific amounts of your income to different expenses. Start by categorizing your expenses into necessities and luxuries. Allocate funds to essential expenses first, then see how much you can afford to spend on non-essential items. Stick to your budget to avoid overspending.

Saving and Investing

Saving money is essential for financial security. Aim to save a portion of your income each month, even if it’s a small amount. Consider opening a savings account or an emergency fund for unexpected expenses. Investing is also a key component of personal finance. It can help grow your wealth over time. Research different investment options like stocks, bonds, or real estate, and consider seeking advice from financial experts.

Managing Debt

Debt can be a significant obstacle in achieving financial freedom. Prioritize paying off high-interest debts like credit card balances. Consider strategies like debt consolidation or refinancing to manage your debts more effectively. Avoid accumulating new debt by living within your means and using credit responsibly.

Planning for the Future

Long-term financial planning is crucial. This includes setting financial goals like buying a house, saving for retirement, or funding your children’s education. Start planning early and consider setting up a retirement account like a 401(k) or an IRA.

Learning More About Personal Finance

For more in-depth knowledge and resources on personal finance, visit Rich Money Mind for Free Learning. This platform offers valuable insights and tips to help you master the art of budgeting, saving, investing, and managing your finances effectively.

Personal finance and budgeting are key skills that every man should master. By understanding your finances, creating a budget, saving and investing wisely, managing debt, and planning for the future, you can achieve financial stability and success. Remember, continuous learning and adapting your financial strategies as your life changes are crucial for long-term financial health. For more resources and learning opportunities, don’t forget to check out Rich Money Mind.

Understanding Money Coming In and Going Out Monthly

Managing personal finances effectively starts with a clear understanding of your monthly income and expenses. This knowledge is crucial for budgeting, saving, and making informed financial decisions. Here’s an in-depth look at how to track and manage your money flow each month.

Tracking Monthly Income

- Identify All Sources of Income: Your primary source of income is typically your salary, but don’t overlook other potential sources. This can include side hustles, freelance work, rental income, dividends from investments, or any passive income streams.

- Understand the Net Income: It’s important to focus on your net income, which is the amount you receive after deductions like taxes, social security, and retirement contributions. This is the actual amount available for your monthly budgeting.

- Regular vs. Irregular Income: Distinguish between regular income (which you receive consistently, like a salary) and irregular income (like bonuses or freelance payments that may fluctuate).

Analyzing Monthly Expenses

- Fixed Expenses: These are recurring expenses that don’t change much from month to month, such as rent or mortgage payments, car payments, insurance premiums, and subscription services. Tracking these is relatively straightforward since they remain constant.

- Variable Expenses: These expenses can fluctuate, such as groceries, dining out, entertainment, and gas. Tracking variable expenses requires more diligence as they can change based on your lifestyle choices.

- One-Time Expenses: Occasionally, you may have one-time expenses like medical bills, car repairs, or gifts. It’s important to account for these in your monthly budget, even though they aren’t regular costs.

Budgeting Techniques

- 50/30/20 Rule: A popular budgeting technique is the 50/30/20 rule, where 50% of your net income goes to necessities, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: This method involves assigning every dollar of your income a specific purpose, whether it’s spending, saving, or investing, ensuring there’s no unallocated or misused money.

- Envelope System: For those who prefer a more hands-on approach, the envelope system involves dividing cash into envelopes designated for different spending categories, helping to curb overspending.

Tools and Resources

- Budgeting Apps: There are numerous apps available that can help track your income and expenses, categorize spending, and even link to your bank accounts for real-time updates.

- Spreadsheets: For those who prefer a more manual approach, spreadsheets can be a powerful tool. You can create custom categories and formulas to track and analyze your finances.

- Financial Advisors: If you find managing your finances challenging, consulting with a financial advisor can provide personalized advice and strategies.

Regular Review and Adjustment

- Monthly Check-ins: Regularly review your budget and spending habits. This helps you stay on track and make adjustments as needed.

- Adapting to Changes: Your financial situation can change due to life events like a new job, a raise, a new family member, or unexpected expenses. Update your budget accordingly to reflect these changes.

Maximizing Financial Management with the Budget Planner

The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is a comprehensive tool designed to assist in managing your money more effectively. This undated finance planner/account book is an essential resource for anyone looking to take control of their financial life. Here’s how this product can be a game-changer in your journey towards financial stability and success.

Customizable and Undated Format

One of the standout features of this budget planner is its undated format. This flexibility allows you to start using it at any point in the year without wasting pages. It’s also customizable, enabling you to tailor it to your specific financial needs and goals. Whether you’re planning for a particular event, tracking monthly expenses, or setting long-term financial goals, this planner adapts to your unique situation.

Comprehensive Expense Tracking

The planner includes detailed sections for tracking all your expenses. By categorizing your spending and recording each transaction, you gain a clearer picture of where your money is going. This visibility is crucial in identifying areas where you can cut back and increase savings. Regular use of the expense tracker can lead to more mindful spending habits and better financial decisions.

Goal Setting and Progress Tracking

Setting financial goals is a key component of effective money management. This budget planner provides dedicated spaces for setting both short-term and long-term financial goals. More importantly, it allows you to track your progress towards these goals, keeping you motivated and on track. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, this planner helps you stay focused on your objectives.

Easy-to-Use Layout

The planner’s user-friendly layout makes it easy for anyone to start budgeting, regardless of their experience with financial planning. The clear, organized sections guide you through the process of documenting your income, expenses, and savings, making it less overwhelming to manage your finances.

Portable and Durable Design

Designed with portability in mind, this budget planner can easily fit in a bag or briefcase, allowing you to track your expenses on the go. Its durable construction ensures that it can withstand daily use, making it a reliable companion in your financial journey.

Educational Resource

For those new to budgeting, this planner serves as an educational tool, teaching the fundamentals of personal finance management. By regularly using it, you’ll learn important financial concepts and develop better money management skills.

The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is more than just a notebook; it’s a comprehensive tool that empowers you to take control of your finances. Its customizable format, detailed expense tracking, goal-setting features, user-friendly layout, portability, and educational value make it an invaluable asset for anyone serious about improving their financial health. Whether you’re a seasoned budgeter or just starting out, this planner is a step towards achieving your financial goals and enhancing your overall financial literacy.

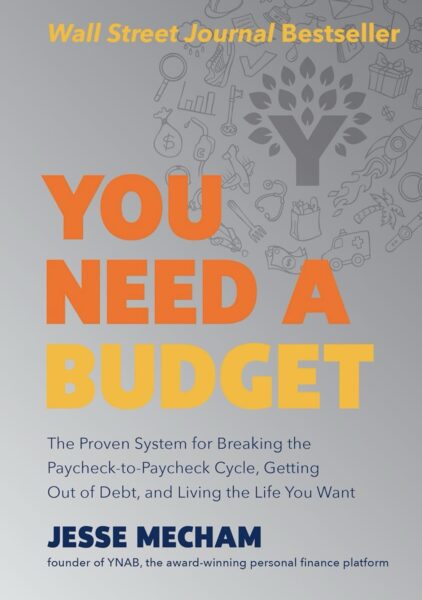

Creating a Budget: Insights from “You Need a Budget”

The book “You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want” offers a comprehensive guide to creating and maintaining a budget that can transform your financial life. This book is not just about managing money; it’s about reshaping your approach to finances. Here’s an in-depth look at the key concepts and strategies for creating a budget as outlined in this insightful resource.

Understanding the YNAB Philosophy

“You Need a Budget” is built around a unique philosophy that challenges conventional budgeting methods. It emphasizes proactive control of your money, encouraging you to give every dollar a job. This approach ensures that you’re actively deciding how to allocate your income, rather than simply tracking expenses or reacting to financial situations as they arise.

The Four Rules of Budgeting

- Give Every Dollar a Job: This rule is about being intentional with your money. Allocate each dollar of your income to specific expenses, savings, debt payments, or investments. This proactive approach prevents wasteful spending and helps you prioritize your financial goals.

- Embrace Your True Expenses: Instead of being caught off guard by large, infrequent expenses, this rule encourages you to break them down into manageable, monthly amounts. This includes things like annual insurance premiums, car maintenance, or holiday gifts. By planning for these expenses in advance, you avoid financial stress and last-minute scrambling.

- Roll with the Punches: Flexibility is key in budgeting. This rule allows for adjustments in your budget as needed. If you overspend in one category, you can adjust by reducing another category. This adaptability prevents you from feeling restricted by your budget and helps you stay on track even when unexpected expenses arise.

- Age Your Money: This concept is about breaking the paycheck-to-paycheck cycle. The goal is to reach a point where the money you’re spending this month was earned at least 30 days ago. This creates a buffer that gives you more financial security and peace of mind.

Practical Steps to Create Your Budget

- Assess Your Financial Situation: Start by gathering all financial statements, including bank accounts, credit cards, loans, and any other debts or assets. This gives you a clear picture of where you stand financially.

- Set Specific Goals: Whether it’s paying off debt, saving for a house, or building an emergency fund, having clear goals gives your budget purpose and direction.

- Categorize Your Expenses: Divide your expenses into categories like housing, utilities, groceries, entertainment, and savings. This helps in allocating funds more effectively.

- Prioritize Your Spending: Allocate funds to essential expenses first, then to your financial goals, and finally to discretionary spending.

- Track and Adjust: Regularly monitor your spending and adjust your budget as needed. This keeps you in line with your financial goals and accommodates changes in your income or expenses.

Leveraging Tools and Resources

Consider using budgeting tools and apps to simplify the process. These can automate some tasks like tracking expenses and categorizing spending, making it easier to stick to your budget.

Creating a budget using the principles from “You Need a Budget” can be a life-changing experience. It’s about more than just numbers; it’s about gaining control over your finances and achieving your life goals. By understanding and applying these principles, you can create a budget that not only works for your current financial situation but also sets you up for long-term financial success.

How Can Men Effectively Track Their Monthly Income and Expenses?

Effective Income and Expense Tracking: For men looking to manage their finances, the first step is to accurately track monthly income and expenses. This can be done using budgeting apps, spreadsheets, or traditional pen-and-paper methods. It’s important to include all sources of income, whether regular or irregular, and categorize expenses into fixed, variable, and one-time costs. Regular monitoring helps in identifying spending patterns and areas where cost-cutting is possible.

What Are Some Practical Budgeting Techniques for Men?

Adopting Suitable Budgeting Methods: Men can choose from various budgeting techniques like the 50/30/20 rule, zero-based budgeting, or the envelope system, depending on their financial goals and lifestyle. The 50/30/20 rule is great for simplicity, zero-based budgeting for detailed financial control, and the envelope system for those who prefer a tangible method of managing cash.

How Important Is It to Save and Invest as Part of Personal Finance?

The Role of Saving and Investing: Saving and investing are critical components of personal finance. It’s essential to set aside a portion of income for savings regularly, even if it’s a small amount. Investing, on the other hand, helps in growing wealth over time. Understanding different investment options and starting early can significantly impact long-term financial health.

What Strategies Can Men Use to Manage and Reduce Debt?

Debt Management Strategies: To manage and reduce debt, men should prioritize paying off high-interest debts first, consider debt consolidation or refinancing options, and avoid accumulating new debt. Creating a debt repayment plan and sticking to a budget are key steps in becoming debt-free.

Why Is Long-Term Financial Planning Important?

Significance of Long-Term Financial Planning: Long-term financial planning is crucial for achieving major life goals, such as buying a home, saving for retirement, or funding children’s education. It involves setting clear financial objectives, creating a plan to achieve them, and regularly reviewing and adjusting the plan as circumstances change.

Where Can Men Find More Resources on Personal Finance and Budgeting?

Finding Additional Resources: For more in-depth knowledge and resources on personal finance and budgeting, men can explore websites, books, and online courses. A valuable resource is Rich Money Mind, which offers a range of articles and tips on various aspects of personal finance, helping men to enhance their financial literacy and management skills.

As an Amazon Associate we earn from qualifying purchases through some links in our articles.